Rising Entrepreneurs: Pathways to Small Business Formation

Justworks and The Harris Poll surveyed employed adults and small business owners to see how their attitudes have changed (or haven’t changed) given the ongoing uncertainty of the U.S. economy. This report comes one year after we surveyed employed adults in the U.S. to gauge how a “looming recession” was impacting dynamics at work. Most notably, findings around starting and running a business directionally show how the sparks of entrepreneurship are coming to fruition one year later…

Key Survey Insights

Concerns about layoffs - In comparison to 2023 when over two in five U.S. employees (42%) were worried about getting laid off due to the looming recession, only one-quarter (25%) are worried about being laid off in 2024.

Sparks of entrepreneurship - 6 in 10 employed adults (59%) are interested in starting their own business or becoming an entrepreneur, but their biggest barriers are feeling like they don’t have enough money (39%) or knowledge to start (29%).

Gen Z and millennials are driving these sparks of entrepreneurship - Employed adults 18-44 are more likely to be interested in starting their own business.

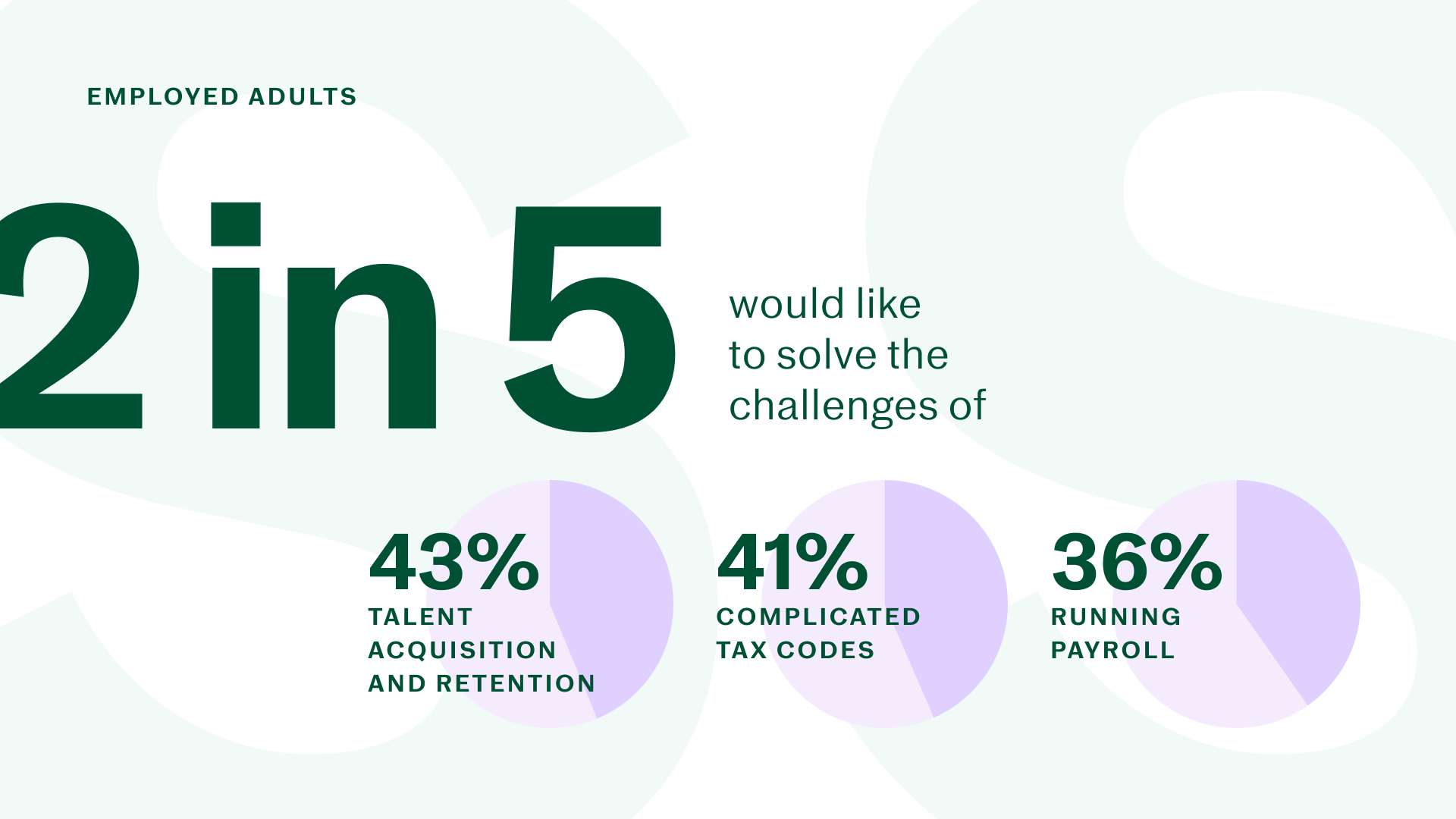

Barriers to entry - Access to capital is (unsurprisingly) the biggest business challenge small business owners would like to solve for, but around 2 in 5 consider complicated tax codes (41%) and managing payroll challenges (36%) within the top three challenges worth solving as well.

What can help entrepreneurs take the leap? - There are several things that could help employed adults feel more confident in becoming an entrepreneur, namely: gaining a better understanding of the financial (34%), operational (32%), and legal (31%) aspects of starting or running a business, having a mentor to help guide them (29%), acquiring capital investment/having initial access to capital (27%), and creating a business plan (27%).

Keeping Employment Options Open

Today’s economic environment has many adults keeping their employment options open and considering contingency plans and alternative employment options for the future. One-quarter of employed adults are worried about being laid off in 2024, and though some don’t feel the economy is favorable for running a business, it is an option that 1 in 5 would consider if they were let go from their job. With the rise in layoffs across industries, there could also be a rise in “accidental entrepreneurs” or “layoffpreneurs” as these workers use this opportunity to explore starting their own businesses.

Currently, 3 in 5 U.S. adults (61%) are open to a new job, including 1 in 5 (21%) actively looking for one.

Roughly 1 in 10 U.S. adults (8%) say they have been laid off in the last 12 months. Among them, many say after being laid off they tried to find work in a role similar to the one they were in (42%) or tried to find work in a different role than they were in (39%). However, nearly 1 in 5 say they started working as an independent contractor (19%) or decided to start their own business (18%).

Among U.S. adults who are currently employed full time or part time (“employed adults”), one-quarter (25%) are worried about being laid off in 2024. 1 in 5 employed adults (19%) say if they were laid off, they would consider starting their own business, especially those who are worried about being laid off (25% vs. 17% not worried).

Nearly 1 in 4 employed adults (22%) don’t feel the economy is favorable now or in the near future for running a business.

Employed adults under 55 are more likely to be worried about being laid off (29% 18-34, 28% 35-44, 25% 45-54 vs. 16% 55-64, 13% 65+) and are more likely to consider starting their own business if they were to be laid off in 2024 (25% 18-34, 21% 35-44, 19% 45-54, 10% 55-64, 5% 65+) Note, base size <100 for employed adults aged 65+.

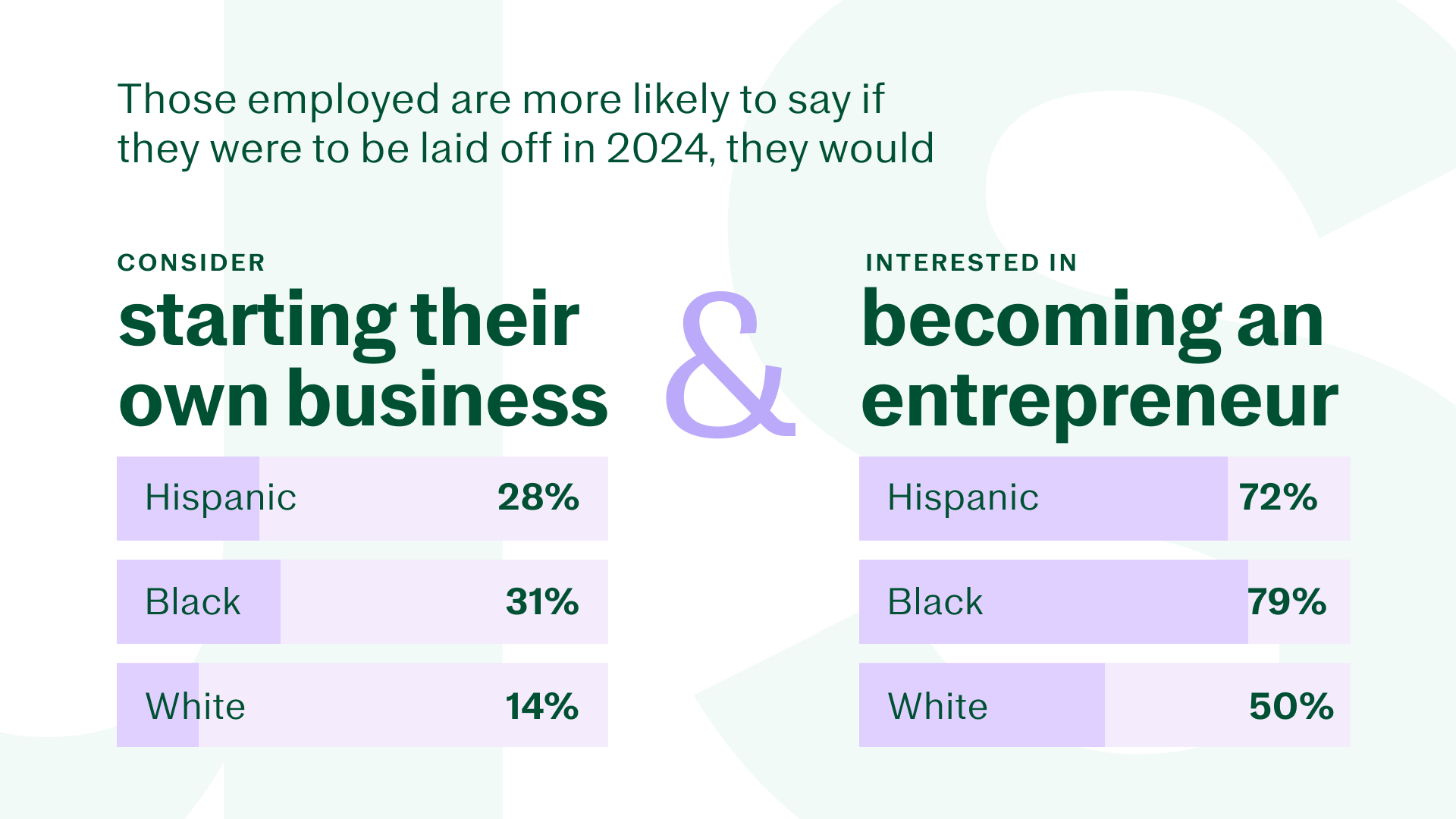

Working Hispanic (18%) and Black (14%) adults are more likely than White adults (6%) to have been laid off in the last 12 months and currently those in these groups who are currently employed are more likely to be very worried about being laid off in the next year (11% vs. 10% vs. 4%).

These groups are not only more likely to be actively looking for a job (32%, 34% vs. 15%), those employed are more likely to say if they were to be laid off in 2024 they would consider starting their own business (28%, 31% vs. 14%) and more likely to be interested in becoming an entrepreneur (72% Hispanic, 79% Black vs. 50% White).

Employed White adults are more likely to say starting a business is risky (90% vs. 82% Hispanic, 80% Black).

1 in 5 employed Black adults (20%) say nothing is holding them back from starting their own business (vs. 9% Hispanic, 9% White), while employed Hispanic adults are more likely to say they don’t know where/how to start (38% vs. 27% White vs. 16% Black,).

Employed Black adults are more likely to say they are confident they could run their own business successfully (84% vs. 70% Hispanic, 69% White).

Barriers to Entrepreneurship

Access to Capital

6 in 10 employed adults are interested in starting their own business or becoming an entrepreneur, but their biggest barriers are feeling like they don’t have enough money or knowledge to start. While most employed adults (87%) agree that starting a business is risky, 3 in 5 (59%) are at least somewhat interested in starting their own business or becoming an entrepreneur, including 1 in 5 (21%) who are very interested.

Many employed adults appear to not be held back by their own biases, stereotypes, or a lack of confidence about business ownership, as 72% agree that anyone can be an entrepreneur if they want to be, and 71% say they are confident they could run their own business successfully.

Rather, what appears to be holding people back from entrepreneurship are financial and knowledge constraints. The biggest barriers to business ownership or becoming an entrepreneur are:

not having enough money or financial resources to start a business (39%)

not knowing where/how to start (29%)

being afraid of the uncertainties involved in running a business (27%)

not knowing enough about running a business (25%)

These barriers are not unfounded, nor uncharted – small business owners echo these experiences:

40% say they didn’t have enough money/financial resources to start their business

31% didn’t know where/how to start

49% had a fear of the uncertainties involved in running a business

29% felt they didn’t know enough about running a business

Back Office - Taxes, Payroll, and Admin

Nearly 1 in 5 employed adults say that not having enough time (17%) or not wanting to manage the administrative aspects of running a business (such as human resources, benefits, payroll, training, taxes, etc.) (17%) is holding them back from starting their own business.

These barriers are not unfounded, nor uncharted – small business owners echo these experiences:

40% say they didn’t have enough money/financial resources to start their business

31% didn’t know where/how to start

49% had a fear of the uncertainties involved in running a business

29% felt they didn’t know enough about running a business

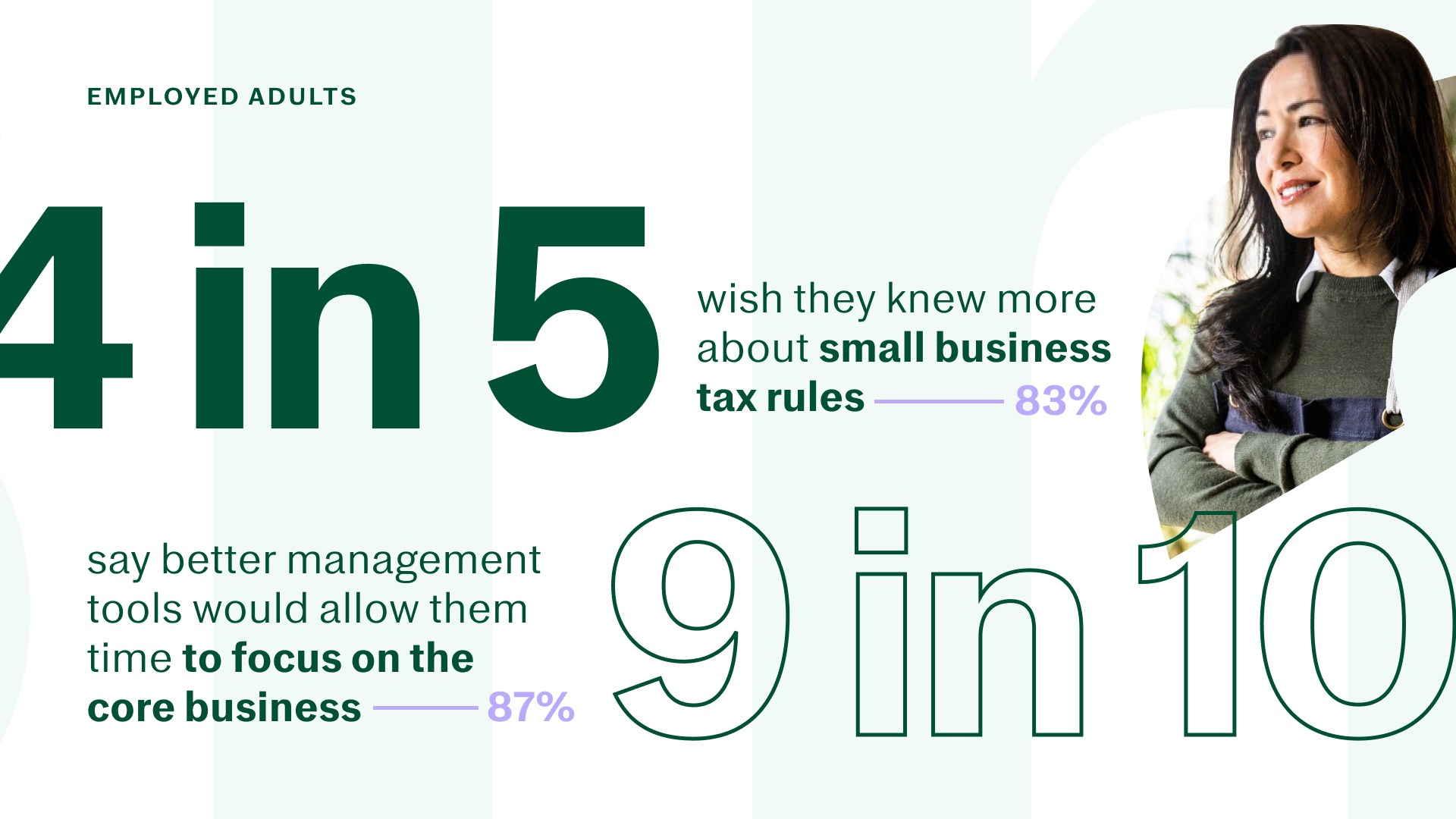

71% of employed adults agree that business tax rules are too complicated and confusing for most people to understand, which may act as another barrier to entrepreneurship – something many small business owners can relate to as 61% say filing taxes was harder than they had anticipated and 83% wish they knew more about small business tax rules.

While a majority of small business owners (59%) say that it has been easier than they anticipated to run a small business, most small business owners who dealt with certain aspects like managing health benefits (67%) and legal documentation (64%) and filing taxes (61%) indicate it was more difficult than they expected.

Access to capital is (unsurprisingly) the biggest business challenge small business owners would like to solve for (66% rank in the top 3), but around 2 in 5 consider complicated tax codes (41%) and managing payroll (36%) challenges worth solving as well. In fact, around 4 in 5 wish they knew more about small business tax rules (83%) and in general wish there were better tools or resources to help them manage their business (80%), with nearly 9 in 10 (87%) agreeing that having better tools to manage administrative aspects of the business would allow them more time to focus on the core business.

Fear of Failure

Another big barrier among small business owners was a fear of failing (59%). Yet today, 59% agree that overall, it has been easier than they had anticipated to run a small business and more than 9 in 10 (93%) would recommend small business ownership to others.

Building Entrepreneurial Confidence

There are several things that could help employed adults feel more confident in becoming an entrepreneur, namely: gaining a better understanding of the financial (34%), operational (32%), and legal (31%) aspects of starting or running a business, having a mentor to help guide them (29%), acquiring capital investment/having initial access to capital (27%), and creating a business plan (27%). Specifically, some say taking relevant educational courses (17%) or participating in relevant seminars or workshops (14%) would build confidence.

Another 1 in 5 (21%) say getting help with the administrative aspects of running a business would help them feel more confident.

In fact, 62% agree that they would be more likely to start their own business if they could outsource the administrative aspects, including 20% who strongly agree. We may know just the partner who can help...

Fear of failing (59%) and not having enough money/financial resources (40%) were common among small business owners, but experience and knowledge from relevant jobs (51%), a business plan (48%), and talking with others who have been through the process (46%) helped boost their confidence.

Today, nearly all small business owners (89%) consider themselves entrepreneurs, including 61% who strongly agree.

Small Business Owners’ Take on Running a Business

Overall, the majority of small business owners (59%) say it has been easier than they had anticipated to run a small business. However, some aspects were easier than they had anticipated while others were more difficult.

Majorities who did each business activity report that managing payroll (57%) and on/offboarding employees (51%) were a little or a lot easier than they had expected, whereas managing health benefits (67%), managing legal documentation (64%), budgeting/forecasting (64%), and filing taxes (61%) were a little or a lot more difficult.

Despite some of these business activities being more difficult than anticipated, strong majorities are satisfied with their ability to efficiently do them today (among those who do these activities). However, only around 2 in 5 or fewer are very satisfied, indicating some room for improvement:

Manage payroll (91% somewhat/very satisfied; 41% very satisfied)

On/Off-boarding employees (86% somewhat/very satisfied; 33% very satisfied)

File taxes (85% somewhat/very satisfied; 38% very satisfied)

Budget/Forecast (82% somewhat/very satisfied; 31% very satisfied)

Manage legal documentation (81% somewhat/very satisfied; 34% very satisfied)

Manage health benefits (78% somewhat/very satisfied; 29% very satisfied)

While there can be many challenges that come with starting or running your own business, small business owners report the ones they’d most like to solve are:

access to money (66% rank in their top 3 challenges to solve for)

difficulty with marketing/brand visibility (60%)

market instability (55%).

Around 2 in 5 would like to solve the challenges of talent acquisition and retention (43%), complicated tax codes (41%), and running payroll (36%).

Small Business Owners Lean on HR Tools

Despite nearly all business owners (98%) using tools, most commonly an accountant (50%) or stand-alone tax software (41%) to help them manage their business taxes, most feel it is not enough. In fact, more than 4 in 5 (83%) wish they knew more about small business tax rules even today.

More broadly, 35% struggled with the administrative aspects of running a business (such as human resources, benefits, payroll, training, taxes, etc.) and 24% did not have enough time to focus on the core of their business (such as the product or service they provide, growing the business, etc.).

While small business owners have likely gotten better at managing these with time, most feel that having better tools would help. To close this gap, Justworks continues to develop and launch products, features, and integrations to help small businesses grow with confidence. .

Most feel that having better tools would help with this – nearly 9 in 10 small business owners (87%) agree that having better tools to manage administrative aspects of the business would allow them more time to focus on their core business.

Despite the challenges and uncertainties, 93% would recommend small business ownership to others, though most (80%) also wish that there were better tools or resources to help them manage their business.

Gen Z and Millennials are Driving Sparks of Entrepreneurship

Younger employed adults are more likely to consider and be interested in entrepreneurship, have unique motivators to help build confidence that include participation in seminars and gaining more knowledge on certain aspects of running a business, and are more likely to start their own business if they could outsource the administrative aspects.

Employed adults 18-44 are more likely to be interested in starting their own business (71% somewhat/very interested 18-34, 69% 35-44 vs. 53% 45-54 vs. 37% 55-64, 32% 65+) Note, base size <100 for employed adults aged 65+.

Employed adults 18-34 are more likely to cite several things that would help build their confidence in starting their own business:

Gaining a better understanding of the financial (40% vs. 31% 35+) or operational aspects of starting/running a business (39% vs. 28% 35+)

Having a mentor (35% vs. 26% 35+)

Creating a business plan (32% vs. 23% 35+)

Talking with someone who owns their own business (30% vs. 22% 35+)

More experience and knowledge from relevant jobs (30% vs.14% 35+)

Finding a business partner (29% vs. 21% 35+)

Participating in relevant seminars or workshops (22% vs.10% 35+)

Employed adults 18-34 are more likely than any other age group to agree that they would be more likely to start their own business if they could outsource the administrative aspects (e.g., payroll, taxes, legal, insurance, etc.) (70% vs. 59% 35-44, 60% 45-54, 53% 55-64, 55% 65+) Note, base size <100 for employed adults aged 65+.

Men and Women’s Varied Perspectives Toward Entrepreneurship

While men (24%) are more likely to consider starting their own business if they were laid off than women (14%), 1 in 4 women (26%) say they are not interested in starting their own business (as compared to 16% of men). 1 in 5 employed women (20%) say nothing would help them feel more confident in starting their own business (in comparison to 16% of men), suggesting that men and women have different attitudes towards barriers to entrepreneurship.

Methodology

The consumer survey was conducted online within the United States by The Harris Poll on behalf of Justworks from January 5-9 among 2,094 U.S. adults ages 18 and older including 1,112 respondents who are employed either full time or part time. Respondents for this survey were selected from among those who have agreed to participate in Harris Poll surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the total sample data is accurate to within ± 2.5 percentage points using a 95% confidence level and the employed adults data is accurate to within ± 3.5 percentage points. These credible intervals will be wider among subsets of the surveyed population of interest.

The small business owner survey was conducted online within the United States by The Harris Poll on behalf of Justworks from January 5-16 among 300 small business owners, defined as U.S. adults 18+ who work full or part time as the CEO, Owner, or Partner of a business with 2-99 employees. Respondents for this survey were selected from among those who have agreed to participate in Harris Poll surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within ± 5.7 percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact press@justworks.com.

Looking for more?

Scale your business and build your team — no matter which way it grows. Access the tools, perks, and resources to help you stay compliant and grow in all 50 states.